http://www.bloomberg.com/news/artic...default-shows-who-profits-at-taxpayer-expense

Share on LinkedInShare on RedditShare on Google+E-mail

Jody Sofia borrowed $92,500 to get a degree from Florida Coastal School of Law. Now she’s in default, her outstanding balance having ballooned to almost $144,000, and she spends her days fielding calls from government-contracted debt collectors.

The companies making those calls are just one part of an ecosystem feeding on federal student loans. There are also debt servicers, refinance lenders, firms that help former students stay out of default and for-profit schools that make money as borrowers try to repay more than $1.2 trillion in government-backed education debt.

Jody Sofia

Photographer: Mike Kane/Bloomberg

Sofia is one of 7 million former students in default on a record $115 billion of federal loans, an amount that has grown almost 25 percent in two years, according to U.S. government data. The mountain of debt, for which taxpayers are on the hook, has provided a stream of revenue to companies at every stage of the process.

“This is not some small cottage industry,” said Rohit Chopra, the former student-loan ombudsman for the U.S. Consumer Financial Protection Bureau, which oversees loan servicers, debt collectors and private student lenders. “There is a large student-loan industrial complex. Rising costs of college and flat family incomes have created enormous business opportunity for every step of the loan process.”

‘Really Wrong’

Sofia, who didn’t take the bar exam and never got a legal job after graduating from Florida Coastal in 2004, says the system is dysfunctional. Derailed by illness and having to care for ailing parents, most of her income has come from working as an independent insurance adjuster, the same thing she was doing before going to law school. While she has made some payments, interest on the loans keeps accruing.

“There’s something really wrong with this system,” said Sofia, 45, who was born in Florida, raised in the New York area and recently moved to the West Coast. “The government is spending all this money for these people to constantly call you. How effective is that?”

Denise Horn, a U.S. Education Department spokeswoman, said the agency has been working to improve the experience of borrowers, hold servicers to higher standards and reduce costs.

“The federal student loan program is a critical tool for keeping college within reach for millions of Americans,” Horn said in an e-mail. “From the earliest days of the Obama administration, we have worked to improve the program for students and families, including by cutting out tens of billions of dollars in wasteful subsidies to private banks.”

‘Unnecessarily Complicated’

Companies that have benefited from the loan program range from debt servicer Affiliated Computer Services Inc., now part of Xerox Corp., to Education Management Corp., which operates for-profit colleges and whose largest shareholder is Goldman Sachs Group Inc. Education Management settled with the government in November for almost $100 million over alleged illegal student-recruitment practices without admitting wrongdoing.

FMS Investment Corp., a unit of Ceannate Corp. that tried to collect from Sofia, was paid $227 million by the Education Department from October 2011 through September of this year, the most of any debt-collection company under contract in that period, according to the agency. Florida Coastal is part of the InfiLaw System, a consortium of three schools. A principal investor in InfiLaw is Sterling Partners, a private-equity firm that also owns a stake in Laureate Education Inc., which is planning an initial public offering next year.

Congress created the loan program 50 years ago with the goal of encouraging students to attend college. Today, the Education Department is one of the largest financial institutions in the country. If it were a bank, it would rank fifth in the U.S. in assets.

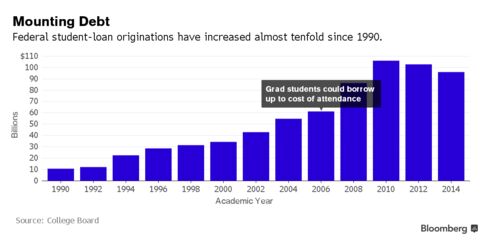

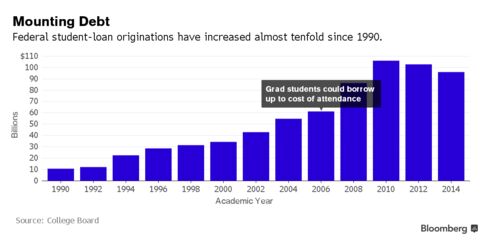

The government has disbursed about $100 billion in education loans annually since the 2009-2010 school year, according to data compiled by the College Board. Just six years before that, the amount was almost half. The total has doubled since 2007 and is expected to double again in the next decade, as students and their parents borrow for college and graduate school. The sum also is increasing because of accrued interest, including on older defaulted loans like Sofia’s.

Students have six months after leaving school to start repaying loans and are considered in default if they haven’t made a payment for at least 270 days. The national default rate of 11.8 percent for borrowers who entered repayment three years ago doesn’t include former students granted forbearance or hardship deferments, or those using repayment programs based on income, where loans are forgiven after at least 20 years.

“The student loan system is unnecessarily complicated, and

See Link

- Private companies benefited as Jody Sofia went into debt

- `At each stage of the process, someone is taking a slice'

Share on LinkedInShare on RedditShare on Google+E-mail

Jody Sofia borrowed $92,500 to get a degree from Florida Coastal School of Law. Now she’s in default, her outstanding balance having ballooned to almost $144,000, and she spends her days fielding calls from government-contracted debt collectors.

The companies making those calls are just one part of an ecosystem feeding on federal student loans. There are also debt servicers, refinance lenders, firms that help former students stay out of default and for-profit schools that make money as borrowers try to repay more than $1.2 trillion in government-backed education debt.

Jody Sofia

Photographer: Mike Kane/Bloomberg

Sofia is one of 7 million former students in default on a record $115 billion of federal loans, an amount that has grown almost 25 percent in two years, according to U.S. government data. The mountain of debt, for which taxpayers are on the hook, has provided a stream of revenue to companies at every stage of the process.

“This is not some small cottage industry,” said Rohit Chopra, the former student-loan ombudsman for the U.S. Consumer Financial Protection Bureau, which oversees loan servicers, debt collectors and private student lenders. “There is a large student-loan industrial complex. Rising costs of college and flat family incomes have created enormous business opportunity for every step of the loan process.”

‘Really Wrong’

Sofia, who didn’t take the bar exam and never got a legal job after graduating from Florida Coastal in 2004, says the system is dysfunctional. Derailed by illness and having to care for ailing parents, most of her income has come from working as an independent insurance adjuster, the same thing she was doing before going to law school. While she has made some payments, interest on the loans keeps accruing.

“There’s something really wrong with this system,” said Sofia, 45, who was born in Florida, raised in the New York area and recently moved to the West Coast. “The government is spending all this money for these people to constantly call you. How effective is that?”

Denise Horn, a U.S. Education Department spokeswoman, said the agency has been working to improve the experience of borrowers, hold servicers to higher standards and reduce costs.

“The federal student loan program is a critical tool for keeping college within reach for millions of Americans,” Horn said in an e-mail. “From the earliest days of the Obama administration, we have worked to improve the program for students and families, including by cutting out tens of billions of dollars in wasteful subsidies to private banks.”

‘Unnecessarily Complicated’

Companies that have benefited from the loan program range from debt servicer Affiliated Computer Services Inc., now part of Xerox Corp., to Education Management Corp., which operates for-profit colleges and whose largest shareholder is Goldman Sachs Group Inc. Education Management settled with the government in November for almost $100 million over alleged illegal student-recruitment practices without admitting wrongdoing.

FMS Investment Corp., a unit of Ceannate Corp. that tried to collect from Sofia, was paid $227 million by the Education Department from October 2011 through September of this year, the most of any debt-collection company under contract in that period, according to the agency. Florida Coastal is part of the InfiLaw System, a consortium of three schools. A principal investor in InfiLaw is Sterling Partners, a private-equity firm that also owns a stake in Laureate Education Inc., which is planning an initial public offering next year.

Congress created the loan program 50 years ago with the goal of encouraging students to attend college. Today, the Education Department is one of the largest financial institutions in the country. If it were a bank, it would rank fifth in the U.S. in assets.

The government has disbursed about $100 billion in education loans annually since the 2009-2010 school year, according to data compiled by the College Board. Just six years before that, the amount was almost half. The total has doubled since 2007 and is expected to double again in the next decade, as students and their parents borrow for college and graduate school. The sum also is increasing because of accrued interest, including on older defaulted loans like Sofia’s.

Students have six months after leaving school to start repaying loans and are considered in default if they haven’t made a payment for at least 270 days. The national default rate of 11.8 percent for borrowers who entered repayment three years ago doesn’t include former students granted forbearance or hardship deferments, or those using repayment programs based on income, where loans are forgiven after at least 20 years.

“The student loan system is unnecessarily complicated, and

See Link